Your current location is:Fxscam News > Exchange Brokers

SEC approves BlackRock Bitcoin option, potentially boosting the Bitcoin market.

Fxscam News2025-07-23 06:03:02【Exchange Brokers】2People have watched

IntroductionForeign exchange bank dealers,Top ten regular foreign exchange platform rankings app,Last Friday, the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot

Last Friday,Foreign exchange bank dealers the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot Options (IBIT), which sparked strong market reactions and bullish sentiment. The IBIT options adopt the American exercise style, allowing holders to exercise their rights at any time before the expiration date, further enhancing the product's flexibility and appeal. Although the SEC has approved this option product, it still awaits further approval from the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC), both of which have not yet provided a specific response time.

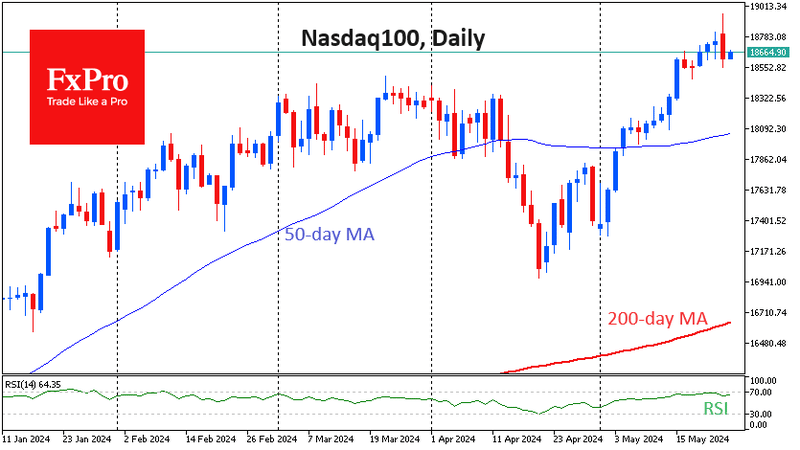

The Bitcoin market has received significant attention in recent years. As the world's largest cryptocurrency by market value, its price volatility and market participation have made it a favored risk asset among investors. The introduction of Bitcoin ETFs and related derivatives offers institutional investors a new avenue to enter this market, increasing its liquidity. The IBIT options are seen as an important hedging and risk management tool that not only helps investors cope with Bitcoin price volatility but also effectively manage the risk exposure of Bitcoin-related positions.

Experts generally believe that the SEC's approval will have a profound impact on the Bitcoin market. Eric Balchunas, Senior ETF Analyst at Bloomberg, pointed out that the approved Bitcoin ETFs will inject more liquidity into the market, attracting more large institutional investors. Jeff Park, Head of Strategy at Bitwise Alpha, is also optimistic about this product, predicting a possible explosive growth in the Bitcoin market. He stated that BlackRock's Bitcoin options will bring enormous demand growth for Bitcoin by providing more tools to help investors enter the market, driving its price to rise rapidly.

The Bitcoin market has experienced several ups and downs in recent years, from the surge in 2017 to the new high in 2021 and the subsequent adjustments and pullbacks, indicating significant volatility. However, with more institutional funds entering and the continuous enrichment of related financial products, the market is gradually maturing. The approval of Bitcoin ETFs and options products not only provides institutional investors with more investment and hedging tools but also marks the gradual recognition of the Bitcoin market by the mainstream financial system.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(2241)

Related articles

- October 25 update: Clear Street expands trading in Canada, MFSA warns about BBFX.

- EIA: Oil Supply Surplus to Intensify Over the Next Two Years

- Trump's tariffs boost gold exports; Singapore's gold exports to the US hit a three

- Oil prices fluctuate as market confidence is boosted by the delay in US tariffs taking effect.

- UBS will fully integrate Credit Suisse's Swiss bank.

- Gold prices hit new highs due to U.S. tariff policies, with tight spot supply providing support.

- Gold drops 1.6%, ending seven

- Rising Ukraine uncertainty boosts gold's safe

- Market Insights: Jan 26th, 2024

- Gold rebounds as market risk aversion intensifies.

Popular Articles

Webmaster recommended

Market Insights: Feb 22nd, 2024

U.S. sanctions drive crude prices to hit limit, sparking attention amid uncertain outlook.

The surge in wheat and soybean short positions marks a critical turning point for the market.

Trump's tariff plan boosts gold prices as the market worries about the global trade outlook.

SSJTCF is taking your money! Watch out!

WTI crude oil falls nearly 3% due to OPEC+ production increase and trade policies.

WTI crude oil prices fell due to increased inventories and trade war concerns.

Chicago wheat futures continued to decline as fears of cold weather eased.